Rick & Dan want to

Maximize your ERC Refund!

We want you to get a complimentary 2nd Opinion!

SCROLL DOWN & FILL OUT THE CONTACT FORM!

Have you been told you don’t qualify for an ERC refund?

Would you like to know for sure but have this nagging fear about alienating your trusted advisor or failing an IRS audit? You wouldn’t be reading our website unless someone you trust sent you here; when you leverage our proprietary Programs, Process, and People then you can rest assured:

- we strategically partner with our suppliers on your behalf (example)

- our team will do what’s right for you just as we’ve done for over 20,000 clients

- and when you legitimately qualify for a refund, then we’ll add your total to the $9+ Billion we’ve delivered so far!

- No Risk to Investigate – Truly a Win – Win – Win!

Take advantage of our complimentary 2nd Opinion!

Fill out the following contact form (or email us at Savings@CostCuttersi.com) and we’ll start working to maximize your refund.

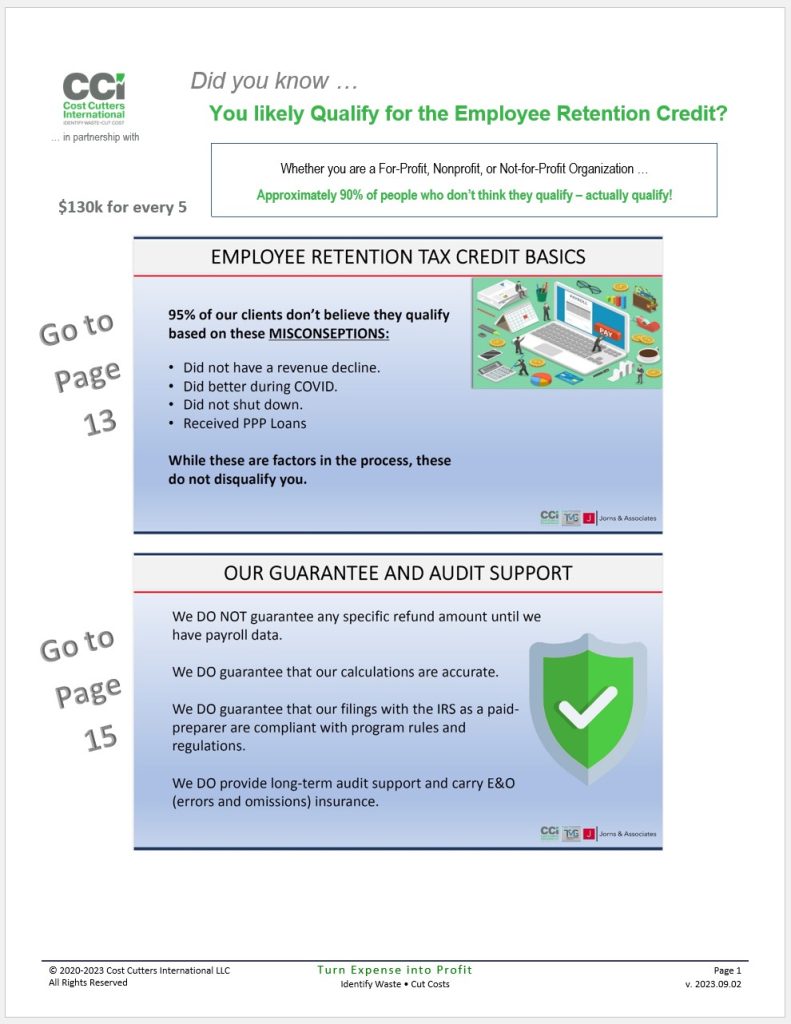

Click here to read results achieved for some of our clients who sought a 2nd Opinion – in this same document you’ll read client testimonials sent to our strategic partner, TMG. Click here or on the “Did You Know…” image to read more details on how we maximize your refund.

Want to watch a video, instead?

- Here’s a quick, 5-minute overview

- Our 12-minute video [slide deck] features CCi’s CEO who will Demystify ERC and help you make an informed decision for your org

- Dive deeper with our 30-minute explanation [slide deck]

Click here to see an example of a Detailed Qualification report which explains why someone’s ERC claim is legitimate.

More Quick-facts you should know about our service:

- Our suppliers’ contingency-based service consistently finds more refund money – money you can use to further your mission

- One client received $1.7 Million vs. $300k; another went from $0 to $720k – now that’s maximizing their refund!

- We even have a unique, Active-Champion program that helps you bless others while earning back the contingency fee

- One of our clients earned over $90,000 with one referral which more than covers their $60,000 contingency fee; another client is earning $14,000 which again more than covers their $10,000 fee!

- While we don’t promise you’ll earn back your contingency fee with one referral – we do promise to help you erase your fee by helping you share your story

Interested in knowing what the IRS has to say?

- Does the IRS Moratorium (Sep 2023) shut down the ERC program? NO! – see our response in CCi green embedded in a word-for-word copy of IR-2023-169

- 7/31/2023 IRS FAQ – word-for-word with our response in CCi green (including excerpts from the Commissioner’s 7/26 release)

- a 102-page Guidance document (Notice 2021-20) with Nominal (non-revenue) qualification tests mentioned 32 times;

- a 10/18/2022 PDF talking about tax relief for Businesses & Nonprofits;

- a 02/28/2023 PDF Update on ERC in the IRS Newsroom; and

- 3/7/2023 IRS News Release – where the IRS issues yet another warning to not file erroneous ERC claims with our response in CCi green

Contact

616.330.1224 | 313.880.1224

savings@costcuttersi.com

Location

1 W. State Rd, Ste 1, Newaygo, MI 49337

Grand Rapids, MI MSA